Fixed Ops Magazine - Jul/Aug 22

To Help Offset the Decline of Service

Although auto sales and service departments have been the hardest hit by the current supply chain and computer chip challenges, they can also be the most significant opportunity for dealership growth and retention. This article will explain how warranty products can increase service retention and help offset the decline of service customers.

THE CURRENT ENVIRONMENT

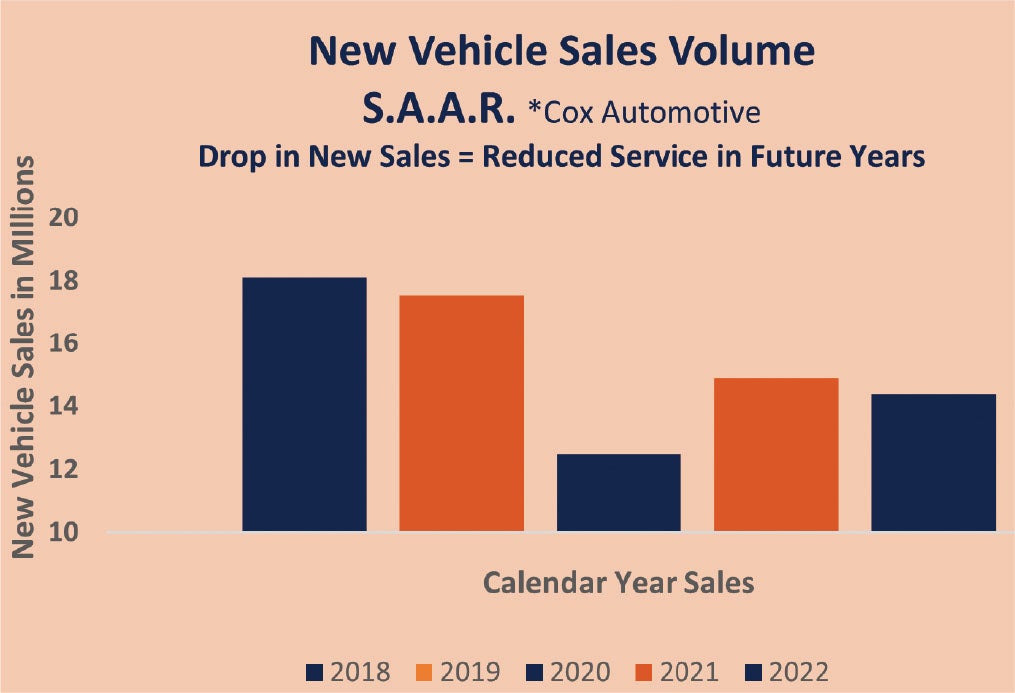

A 20% drop in new vehicle sales, down from 18.1 million SAAR (Seasonal Adjusted Annual Rate) in 2018 to a projected 14.4 million in 2022, negatively affects future service department sales across the country. Fewer unit sales today equal fewer customers coming back for service tomorrow. In addition to the lack of inventory production, OEMs are shifting focus from ICE (internal combustion engines) to EV (Electric Vehicles). This will further strain fixed operations, as EVs require less essential maintenance and shop hours than ICE units. These two factors will force dealerships across the country to switch their focus to used vehicle service retention as an offset to the reduction in new vehicle volume.

NEW FOCUS ON USED VEHICLE RETENTION RATES

Unlike with new units, OEMs and dealerships don’t focus on KPI (Key Performance Indicator) index reports for used vehicles. This lack of focus and reference makes it challenging to get exact numbers on retention rates of used cars sold at franchise locations.

THE MOST SIGNIFICANT OPPORTUNITY FOR GROWTH

The following is a typical illustration of a used car department being the most significant opportunity for growth to offset a dealership’s slumping new vehicle inventory issues: A Ford store sells a used 2020 Toyota Camry. How often does that Camry (non-OEM) customer utilize the selling dealership’s service department for oil changes, replacement tires, wipers, etc? Our estimate of the user retention rate nationally is less than 5%.

PRELOADS AS A SOLUTION TO ENCOURAGE RETENTION

In an effort to increase service retention, one potential solution is to offer a lifetime battery warranty. All used vehicles get one year of battery replacement regardless of make, model, year, or mileage. By offering the preload as a warranty,

you can dictate where the consumer can go for the battery replacement, i.e., your dealership. This why-buy-here is not only a differentiator for your location. It will also drive those non-OEM used units back to your dealership. This newly created opportunity allows the Service Advisors to upsell other maintenance items like new tires, and filters, etc. These additional service customers equal increased labor hours.

SERVICE ADVISOR OPPORTUNITIES FOR FUTURE RETENTION

Both customer-pay and warranty battery customers are offered a lifetime battery warranty on all new battery installs. The lifetime battery warranty is compatible with the brand of battery your specific dealership sells. With retail price points from $99-$150 for the lifetime battery warranty, you will see customer-take rates averaging between 50% and 90%. This increases future retention and gives fixed operations another way to monetize and increase the repair order.

F&I OPPORTUNITIES

In addition, the warranty battery product provides F&I with an additional opportunity to monetize and increase PVR. Lifetime battery coverages can be offered on new or used vehicles and fully integrate with all significant menu providers. Since they have retail price points from $399 to $599, this newly added ancillary product is showing percentages of 10% to 20% penetration nationally. It is a perfect product for a customer who intends to hold onto the car “forever”.

SUMMARY

Regardless of which approach a store utilizes with a lifetime battery warranty program, the ability for a dealership to innovate and stay ahead of the ever- changing landscape is paramount. For a dealership to succeed against volume headwinds and increase their service retention, they must look for products to help grow service retention.

Scott Lear is president of Dealer Benefit, a full solutions product company geared to automotive dealerships. Dealer Benefit brings products to market through technology and innovation allowing dealership’s a new way to monetize. Scott started selling cars in 1993 while home from college at Auburn University and has been involved in the automotive industry ever since. He can be reached at slear@dealerbenefit.com